1. Growth Drivers and Challenges in the U.S. Solar Market

Since 2013, the cost of solar energy in the U.S. has been lower than coal, making it one of the most affordable energy sources. However, over the past decade, solar installations have experienced two significant downturns due to changes in the Investment Tax Credit (ITC) policy and import restrictions on Chinese components. Ground-mounted solar systems account for 60-70% of total U.S. installations. Recently, residential installations have slowed due to rising interest rates and changes in state policies. Despite this, ground-mounted projects continue to deliver solid returns, supported by the ITC. As interest rates fall and ITC benefits persist, solar installations are expected to grow.

Solar now holds a notable share in the energy mix, but it still lags behind fossil fuels. The Biden administration’s extension of ITC policies provides long-term support for solar growth. With strong project reserves, the U.S. solar market is expected to sustain double-digit growth over the next two years. The International Energy Agency (IEA) predicts that in 2024, large-scale solar projects (over 1MW) will add 36.4GW, accounting for 58% of new power capacity in the U.S. Due to limited domestic production (less than 7GW at the end of 2023), over two-thirds of solar components rely on imports.

2. Impact of Tariffs on Southeast Asia's Solar Supply Chain

U.S. anti-dumping and countervailing duties on Chinese solar companies have shifted production to Southeast Asia, making the region a primary supplier to the U.S. High tariffs and supply chain restrictions have forced companies to relocate capacity to Southeast Asia. However, new sanctions may limit production in Southeast Asia, driving up costs and affecting U.S. supply. In the short term, the U.S. will continue to depend on Southeast Asia for solar cells and upstream components, while long-term solutions will likely focus on building domestic capacity to avoid tariffs.

3. The U.S. Solar Industry and the Impact of the IRA

The U.S. solar industry has greatly benefited from the Inflation Reduction Act (IRA), which extended ITC incentives and introduced major supply-side subsidies to encourage local manufacturing. These subsidies aim to strengthen the domestic solar supply chain, offering substantial support to component and material producers. Labor standards and domestic content requirements further push for localized production, a trend expected to intensify in the coming years.

4. U.S. Solar Subsidies and Their Impact

The IRA's generous subsidies have revitalized U.S. solar companies like First Solar, turning them profitable. These policies not only improve short-term financial performance but are essential for long-term profitability. As domestic capacity increases, subsidies will further enhance competitiveness. With limited supply, module prices are expected to rise, easing concerns about price declines. While the U.S. faces challenges with silicon supply, expanding domestic production and leveraging existing subsidies will help maintain global competitiveness. Analysis suggests that while profitability for Southeast Asian integrated modules may decline due to tariffs, using U.S. cells with Southeast Asian assembly remains profitable.

5. Challenges and Opportunities for Chinese Solar Companies in the U.S.

Chinese companies such as Canadian Solar and LONGi are expanding their production in the U.S., underscoring the importance of local manufacturing for long-term success. Despite challenges in building and maintaining local facilities, investing in cell production capacity is vital for future growth. Companies that focus on localization and building strong government relations are more likely to succeed in the U.S. market and generate sustained profits. Investors should monitor changes in subsidies, tariffs, and patent risks to capitalize on opportunities.

6. U.S. Solar Policies and Installation Outlook

Ground-mounted projects in the U.S. remain highly profitable. Despite high interest rates (around 8.5%), these projects yield approximately 8.38%, largely due to ITC benefits, which reduce tax liabilities by 30%, lowering investment costs.

As interest rates decline, solar project returns are expected to improve. For instance, a 1% decrease in interest rates will increase returns over the life of a solar project. While solar has accounted for more than 50% of new installations in recent years, it still represents only about 5% of total power capacity, leaving substantial room for growth.

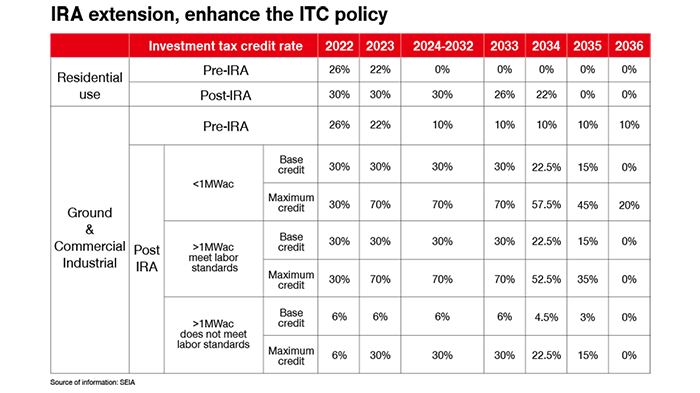

The ITC has been a key driver of U.S. solar growth since 2005, with subsidies ranging from 26-30%. The Biden administration’s IRA extended ITC benefits through 2032, providing strong support for future solar expansion.

U.S. solar installations are projected to grow rapidly over the next few years. By the first quarter of 2024, more than 100GW of solar projects are in the pipeline, supporting installation growth for the next 2-3 years. Estimates show the U.S. could install 43-45GW in 2024, with growth of over 20% expected in 2025.

U.S. solar modules have key advantages: they receive a 7-cent per watt subsidy under the IRA, are exempt from some tariffs on Southeast Asian cells, and can qualify for an additional 10% ITC bonus, adding a premium. This makes U.S. modules more competitive and profitable compared to fully integrated Southeast Asian modules.